Problem Statement:

The over-reliance on credit cards and loans has led to high levels of personal debt, causing significant financial stress for many individuals. This issue is exacerbated when individuals do not fully understand the terms and implications of borrowing, leading to cycles of debt that are difficult to break. High-interest rates, fees, and penalties can quickly accumulate, making it challenging for borrowers to manage and reduce their debt. Additionally, the lack of financial literacy and resources further complicates the situation, preventing individuals from making informed decisions and effectively managing their finances. This platform aims to address these issues by providing comprehensive debt management tools, educational resources, and personalized financial guidance to help individuals break free from the debt cycle and achieve financial stability.

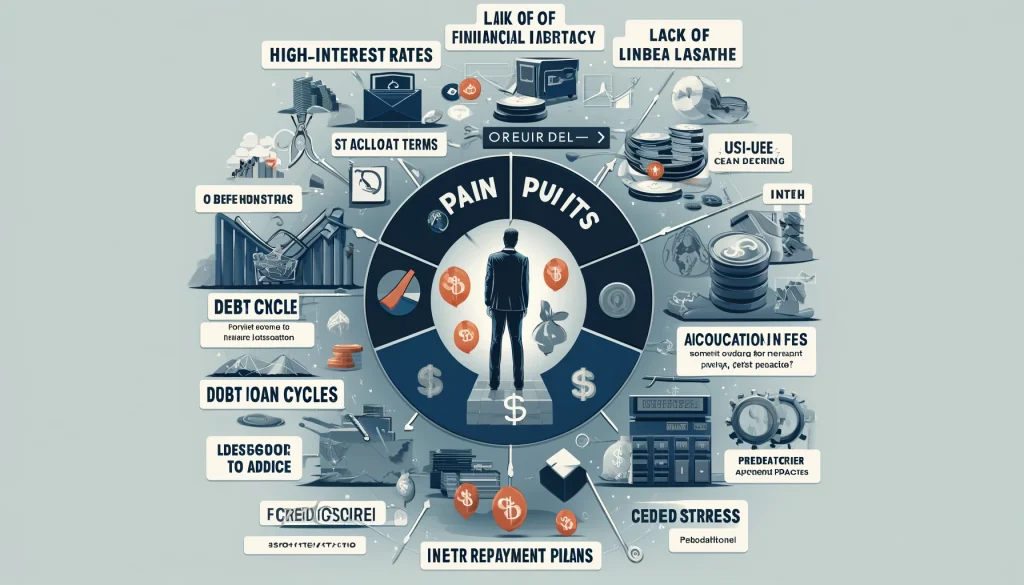

Pain Points:

- High-Interest Rates: Borrowers face high-interest rates that increase the total repayment amount.

- Complex Loan Terms: Difficulty understanding the terms and conditions of credit cards and loans.

- Accumulation of Fees: Excessive fees and penalties that add to the debt burden.

- Lack of Financial Literacy: Limited understanding of financial management and debt reduction strategies.

- Debt Cycles: Repeated borrowing leading to a cycle of debt.

- Credit Score Impact: Negative effects on credit scores due to missed payments or high debt levels.

- Limited Access to Advice: Lack of affordable and personalized financial guidance.

- Financial Stress: Emotional and mental stress associated with high debt levels.

- Inadequate Repayment Plans: Difficulty finding manageable repayment plans.

- Predatory Lending Practices: Exposure to predatory lending practices that exploit vulnerable borrowers.

Future Vision:

The proposed platform aims to empower individuals with the tools and knowledge needed to manage and reduce their personal debt effectively. It will provide a comprehensive suite of debt management tools, including debt calculators, repayment plan generators, and budgeting aids. Educational resources will cover topics such as understanding loan terms, improving credit scores, and strategies for debt reduction. Personalized financial guidance will be available through virtual financial advisors and support forums. The platform will also offer alerts and reminders for upcoming payments to help users stay on track. By integrating data analytics, the platform will provide tailored advice and track users’ progress towards financial stability. The ultimate goal is to reduce financial stress, improve credit scores, and help individuals achieve long-term financial health.

Use Cases:

- Debt Management Tools: Users can access calculators and tools to understand their debt and create repayment plans.

- Financial Education: Offering courses and resources on financial literacy, debt reduction, and credit management.

- Personalized Financial Guidance: Virtual financial advisors provide tailored advice based on individual financial situations.

- Budgeting Assistance: Interactive budgeting tools to help users manage their finances.

- Payment Alerts: Reminders and alerts for upcoming payments to avoid late fees.

- Credit Score Improvement: Resources and tools to help users improve their credit scores.

- Support Forums: Community support and forums for sharing experiences and advice.

- Debt Consolidation: Information and resources on debt consolidation options.

- Emergency Savings: Tools and advice for building emergency savings funds.

- Monitoring and Tracking: Users can monitor their progress towards financial stability and receive regular updates.

Target Users and Stakeholders:

- Target Users: Individuals with high levels of personal debt, low financial literacy, and those seeking to improve their financial health.

- Age Group: 18-65+

- Gender: All genders

- Usage Pattern: Regular usage for debt management tools, periodic engagement for educational resources and financial guidance.

- Benefit: Reduced debt levels, improved financial literacy, better financial stability.

- Stakeholders:

- Users: Individuals seeking debt management and financial education.

- Financial Institutions: Banks and credit unions offering debt consolidation and financial products.

- Educational Institutions: Schools and colleges providing financial literacy programs.

- Non-Profit Organizations: Entities focused on financial education and debt relief.

- Government Agencies: Agencies promoting financial literacy and responsible borrowing.

Key Competition:

- Competitors: Companies and platforms like Credit Karma, Mint, NerdWallet, and Experian that offer financial management and credit score improvement tools.

Products/Services:

- Credit Karma: Provides free credit scores, reports, and monitoring services.

- Mint: Offers budgeting tools, bill tracking, and financial planning resources.

- NerdWallet: Focuses on personal finance advice and tools for managing debt and improving credit.

- Experian: Offers credit reports, scores, and credit monitoring services.

Active Startups:

- Tally: Provides automated debt management and credit card repayment tools.

- Chime: Offers fee-free banking and early direct deposit, helping users avoid overdraft fees.

- SoFi: Provides student loan refinancing, personal loans, and financial planning services.

- Earnin: Allows users to access earned wages before payday, helping avoid high-interest loans.

- Upstart: Uses AI to provide personal loans and refinancing options.

- TrueAccord: Offers debt collection services with a focus on customer engagement and repayment solutions.

- Credible: Provides a marketplace for comparing loan and refinancing options.

- Acorns: Helps users invest spare change and build savings.

- Greenlight: Offers a debit card and app for kids to teach financial responsibility.

- Zebit: Provides interest-free credit for purchases, targeting underserved consumers.

Ongoing Work in Related Areas:

- Development of AI-driven financial education tools.

- Expansion of digital platforms for debt management.

- Increased focus on personalized financial advice through virtual financial advisors.

- Integration of financial wellness programs in workplaces.

- Collaboration between fintech companies and traditional financial institutions.

Recent Investment:

- Tally: Raised $50 million in Series C funding in 2021.

- Chime: Secured $750 million in Series G funding in August 2021.

- SoFi: Raised $500 million in a private funding round in 2021.

- Earnin: Raised $125 million in Series C funding in 2019.

Market Maturity:

The market for debt management and financial education platforms is growing, driven by increasing consumer debt levels and a greater awareness of financial literacy’s importance. Established players and new startups are continually innovating to offer more personalized and effective solutions.

Summary:

The over-reliance on credit cards and loans has resulted in high personal debt levels, leading to significant financial stress for many individuals. This problem is compounded by a lack of understanding of loan terms and borrowing implications, causing cycles of debt that are hard to escape. The proposed platform aims to address these issues by providing comprehensive debt management tools, educational resources, and personalized financial guidance. It will offer a range of services, including debt calculators, repayment plans, budgeting aids, and virtual financial advisors. Educational resources will help users understand loan terms, improve credit scores, and develop strategies for debt reduction. Key competitors in this space include platforms like Credit Karma, Mint, NerdWallet, and Experian. Active startups such as Tally, Chime, and SoFi are also making significant strides in debt management and financial planning. Recent investments indicate strong market interest and growth potential. The platform aims to empower individuals with the knowledge and tools to manage their debt effectively, reduce financial stress, and achieve long-term financial stability.