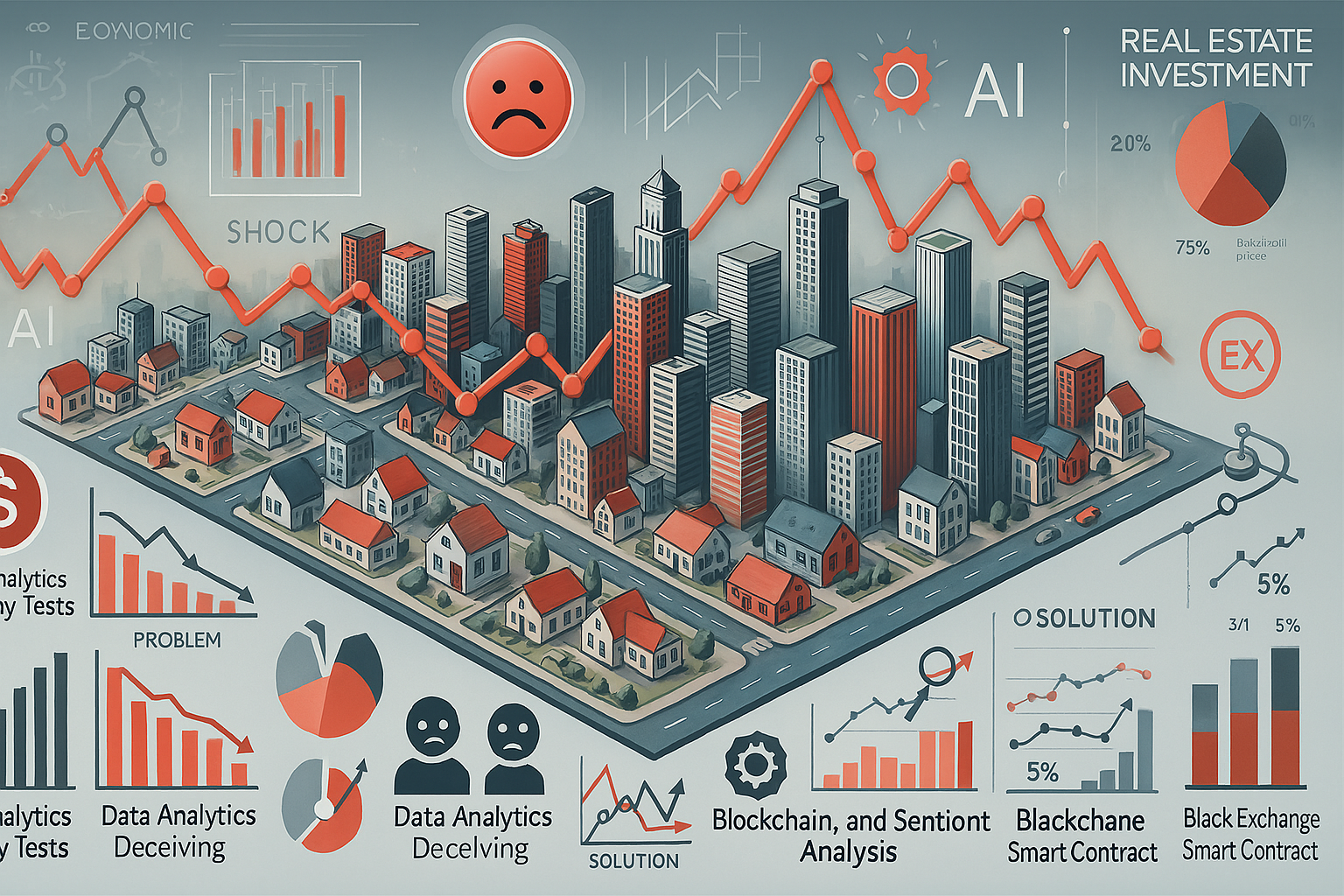

Problem Statement

Real estate investments are traditionally considered stable, but economic downturns expose a critical vulnerability—demand collapse, price deflation, and stagnant returns. During periods of financial instability, investor confidence weakens, credit availability shrinks, and property sales decline. This leads to longer holding periods, cash flow problems, and uncertainty in achieving ROI goals. Current real estate platforms are transaction-focused and fail to integrate market forecasting, risk modeling, or real-time demand analytics, leaving investors ill-equipped to make data-driven decisions during uncertain times. The lack of predictive insights and a centralized risk dashboard means that developers, property investors, and institutional stakeholders often act reactively, rather than strategically.

What’s needed is a dynamic, AI-powered risk and forecasting platform that offers real-time market insights, predictive pricing models, and investment viability scores. It should help investors mitigate losses, shift strategy in real-time, and make informed decisions based on future risk scenarios. This will redefine the way real estate stakeholders respond to economic shifts, offering stability, visibility, and control in an unpredictable market.

Pain Points

- Demand Collapse

In downturns, fewer buyers mean lower liquidity and longer time to exit investments, creating holding cost burdens. - Price Volatility

Fluctuating property prices make it difficult to plan, budget, or predict profit margins accurately. - Delayed ROI

Project completion delays combined with weak market demand push expected ROI timelines further out, straining cash flow. - Poor Market Forecasting Tools

Existing tools don’t offer predictive capabilities, leaving investors blind to future downturn indicators. - Investor Panic & Irrational Decisions

Fear-driven reactions often lead to rushed asset liquidation or poor strategic adjustments. - Overleveraging Risk

Falling valuations increase debt-to-value ratios, threatening loan covenants and triggering financial distress. - Unsold Inventory Pile-Up

Developers struggle to offload units, causing inventory surpluses and operational cash flow problems. - Mismatched Valuations

Disparity between listed prices and actual market sentiment causes confusion and slow transactions. - Ineffective Diversification Strategy

Lack of actionable insight leads to investing in poorly performing zones or asset types. - Regulatory Instability Awareness

Delayed awareness of government policies (e.g. tax reliefs, moratoriums) results in missed mitigation opportunities.

Key Competitors

- HouseCanary

Provides advanced analytics and valuation models, offering real estate agents precise property valuations and market forecasts. - Reonomy

Offers AI-driven market analysis and predictive analytics, enabling investors to identify lucrative opportunities and assess market trends. - PropStream

Provides AI-driven predictive analytics and advanced data tools, allowing investors to make informed real estate decisions. - CoreLogic

Delivers comprehensive property data and advanced analytics, assisting agents in understanding market trends and property values. - Skyline AI

Utilizes AI for real-time analysis of commercial real estate, offering insights into property performance and market trends.

Major Offerings by Competitors

- Predictive Market Analytics

Tools that forecast market trends and property valuations using AI algorithms.Forbes+1housecanary.com+1 - Property Valuation Models

Advanced models providing accurate property valuations based on extensive data analysis.HousingWire - Risk Assessment Tools

Features that evaluate potential investment risks by analyzing market conditions and property data. - Portfolio Management Solutions

Platforms assisting investors in managing and optimizing their real estate portfolios. - Market Trend Analysis

Insights into current and projected market trends to inform investment decisions. - Data Visualization Dashboards

Interactive dashboards presenting complex data in an understandable format. - Lead Generation Tools

Features that identify potential buyers or sellers based on market data. - CRM Integrations

Integration with Customer Relationship Management systems to streamline client interactions. - Automated Reporting

Tools that generate reports on market analysis, property performance, and investment opportunities. - Geospatial Analysis

Utilization of geographic data to assess property locations and surrounding amenities.

Key Gaps Faced by Users

Despite many tools available, investors still lack:

- Integrated forecasting and risk scoring

- Real-time demand drop alerts

- Scenario-based investment simulations

- Diversification intelligence

- Micro-market stress testing

Product Vision

LandBridge aims to become the ultimate predictive investment platform for real estate stakeholders navigating economic volatility. At its core is a risk-aware AI engine that uses real-time data to anticipate demand trends, project ROI, and simulate investment scenarios based on evolving market conditions.The platform integrates dynamic economic indicators, geospatial insights, and regulatory data to forecast not just the what, but the why and what next for property investments. This enables investors to confidently shift strategies before downturns affect profits.

Unlike traditional listing or valuation tools, LandBridge offers “Investor Risk Dashboards”, “Smart Diversification Maps”, and “Future ROI Simulators” tailored to various economic cycles. By embedding blockchain-backed transaction transparency, it ensures trust in all valuations and predictions. LandBridge will also feature an AI-powered advisory assistant, recommending moves like switching asset classes, refinancing, or liquidating properties based on risk exposure levels. Ultimately, LandBridge empowers stakeholders to protect investments, identify counter-cyclical opportunities, and make fearless, future-ready decisions.

Use Cases

- Predictive Demand & Price Analytics

- Market Crash Alerts and Risk Score Updates

- ROI Simulators Based on Custom Scenarios

- Portfolio Diversification Strategy Assistant

- Area-Based Stress Testing (Micro-Market Analysis)

- Blockchain-Powered Valuation History Ledger

- Policy Change Impact Forecasting

- Dynamic Investor Dashboards with Live KPI Feeds

- Recession-Proof Investment Suggestions

- Real-Time Financial Health Reports for Properties

Use Case 1

- Use Case: Predictive Demand & Price Analytics

- Short Info: Forecasts future real estate demand and property prices using AI.

- Reference: Vision, Pain Point 1, Competitor gap in forecasting.

- Stakeholders: Real estate investors, analysts, developers.

- Elaboration: This use case leverages real-time economic indicators, sentiment analysis, and past transaction data to predict how demand and prices will shift in the near and medium term. The system identifies micro-market trends and visualizes heat maps indicating “hot” and “cooling” zones. For example, if employment drops in a region, LandBridge proactively downgrades the investment risk rating of that area. Investors can set alerts for threshold changes in demand metrics.

- Requirements:

- Integration with real estate transaction databases

- AI model for trend forecasting

- Heatmap visualization tools

- Alert engine for demand shifts

- Market health scoring system

- Integration with news sentiment APIs

- Dashboard with filters by region/property type

- User-defined forecasting horizons

- Explanation of prediction rationale

- Exportable forecast reports

Use Case 2

- Use Case: Market Crash Alerts and Risk Score Updates

- Short Info: Detects early signs of market downturns and adjusts investment risk scores.

- Reference: Pain Points 1, 4, and Vision.

- Stakeholders: Investors, financial institutions, property developers.

- Elaboration: The platform monitors leading indicators such as interest rate changes, unemployment trends, policy shifts, and consumer sentiment. When a defined combination of indicators signals potential instability, users receive real-time alerts with personalized insights. Risk scores for properties and portfolios are updated dynamically. Alerts come with explanations and suggested mitigations like hedging or asset reallocation.

- Requirements:

- Risk scoring engine

- Threshold-based alert configuration

- Macroeconomic indicator integration

- Personalized risk profiles

- Alert history log

- AI-generated recommendations

- Notification system (email/SMS/push)

- Scenario simulation tool

- Dashboard visualizations

- Historical comparison view

Use Case 3

- Use Case: ROI Simulators Based on Custom Scenarios

- Short Info: Simulates returns based on user-defined economic and local scenarios.

- Reference: Vision, Pain Points 2, 3, 10.

- Stakeholders: Investors, developers, analysts.

- Elaboration: Users can input hypothetical scenarios—e.g., 5% price drop, 10% rental decrease—and see how ROI projections change across properties or portfolios. The engine simulates outcomes across holding periods, rent projections, maintenance costs, and financing terms. This feature helps in pre-empting losses and optimizing strategy.

- Requirements:

- ROI calculator engine

- User-defined scenario editor

- Graphical ROI visualizations

- Data integration from real estate and financial markets

- Adjustable cost parameters

- Multiple investment strategies comparison

- Save/load scenario profiles

- Risk-adjusted ROI outputs

- Forecast adjustment tool

- Detailed output reports

Use Case 4

- Use Case: Portfolio Diversification Strategy Assistant

- Short Info: AI-powered advisor for diversifying real estate investments.

- Reference: Pain Point 9, Vision.

- Stakeholders: Investors, wealth managers.

- Elaboration: The assistant reviews an investor’s existing portfolio (by location, asset class, risk level), then recommends areas of overexposure and untapped opportunities. It suggests rebalancing strategies—e.g., shifting from residential to commercial, or from metro to tier-2 zones—based on risk appetite and market signals.

- Requirements:

- Portfolio input interface

- Diversification index computation

- Risk-reward mapping engine

- Asset-class trend forecasts

- Personalized strategy plans

- Suggested property matches

- Geographic exposure visualization

- AI-powered chat advisor

- Multi-language support

- Export strategy summary

Use Case 5

- Use Case: Area-Based Stress Testing (Micro-Market Analysis)

- Short Info: Tests market resilience under simulated downturn scenarios.

- Reference: Pain Points 1, 2, 7; Vision.

- Stakeholders: Developers, city planners, institutional investors.

- Elaboration: LandBridge simulates stress conditions like credit tightening or rental collapse in micro-markets (e.g., specific zip codes or districts). The model estimates time-to-liquidation, occupancy impacts, and asset value drops. Helps in determining which areas are likely to hold value and which are vulnerable.

- Requirements:

- Localized economic data mapping

- Stress simulation scenarios

- Occupancy and liquidity modeling

- Geospatial risk overlay

- Comparison across zones

- Historical downturn data integration

- User-customized stress factors

- AI learning from past downturns

- PDF/CSV report exports

- Real-time heatmap updates

Summary

The global real estate market, often seen as a pillar of wealth creation, faces immense stress during economic downturns. Property values fluctuate, investor confidence declines, and data ambiguity makes risk management challenging. Our research identified 10 critical pain points ranging from lack of transparency and risk modeling gaps to external economic shocks and delayed exits.

In response, we conceptualized LandBridge — a comprehensive AI-driven platform designed to make real estate investing smarter, safer, and more resilient. LandBridge integrates real-time data analytics, blockchain for valuation histories, sentiment tracking, economic modeling, and risk-based personalized dashboards. This not only empowers investors with insights but also reduces dependency on speculation.

Through competitive analysis, we recognized market gaps such as fragmented data solutions and lack of predictive foresight. Our platform goes beyond by offering use cases like predictive cash flow modeling, recession-proof investment insights, geo-spatial heatmaps for upcoming hotspots, and real-time liquidity forecasting. All modules are developed with a high empathy for the user journey — making tools intuitive, actionable, and scalable. With this foundation laid, we are ready to build a transformative, future-ready product

Published by Bhagyashree Ingale, JSPM Univercity Pune