Problem Statement :

As populations in many countries age, financial firms are confronted with the pressing need to adapt their products and services to meet the unique demands of older customers. This demographic shift requires a nuanced approach that balances innovation with inclusivity. Older adults often have distinct financial needs, such as retirement planning, long-term care, and estate management, which require specialized financial products and services. However, the growing trend towards digitalization in the financial sector poses a significant challenge, as many older individuals may struggle with or feel uncomfortable using digital platforms.

For financial firms, the challenge is twofold: they must innovate to provide sophisticated, tech-driven solutions while also ensuring that these innovations are accessible to all customers, including those who may not be as digitally savvy. This involves designing user-friendly interfaces, offering personalized customer support, and creating products that are specifically tailored to the financial goals and concerns of older adults. Additionally, firms must address issues such as cybersecurity, as older adults can be more vulnerable to fraud and scams.

In this evolving landscape, the success of financial firms will hinge on their ability to create inclusive, secure, and effective financial solutions that cater to the aging population while continuing to drive digital transformation. By doing so, they can not only meet the needs of this growing demographic but also enhance customer loyalty and satisfaction across all age groups.

Pain Points:

- Digital Divide: Older adults may struggle with or feel uncomfortable using digital financial platforms.

- Retirement Planning: Need for specialized financial products to support retirement income, savings, and investments.

- Long-Term Care Costs: Difficulty in planning and managing expenses related to long-term care.

- Estate Management: Complexity in managing and transferring wealth, including wills, trusts, and inheritance.

- Accessibility: Ensuring that financial services are accessible to those with physical or cognitive impairments.

- Customer Support: Demand for personalized, human-centric customer service that can address the concerns of older clients.

- Cybersecurity Risks: Increased vulnerability of older adults to fraud, phishing, and other online scams.

- Trust in Technology: Skepticism or lack of trust in digital financial tools and services among older adults.

- Regulatory Compliance: Navigating complex regulations related to elder financial protection and fiduciary responsibilities.

- Financial Literacy: Addressing varying levels of financial literacy among older customers to ensure they can make informed decisions.

Future Vision:

The future of financial services for aging populations lies in a delicate balance between innovation and inclusivity. Financial firms must develop products and services that are both technologically advanced and easy to use, catering to the specific needs of older adults. This involves creating user interfaces that are intuitive and accessible, with clear, simple navigation and options for assistance when needed. Firms should also consider offering hybrid solutions that combine digital tools with traditional in-person or telephone support, ensuring that older customers have access to the help they need in a format they are comfortable with.

In addition to improving accessibility, financial institutions will need to focus on designing products that address the financial challenges associated with aging, such as retirement income, healthcare costs, and estate planning. This could include developing annuities with flexible payout options, long-term care insurance products, and comprehensive estate planning services that integrate legal and financial advice.

Cybersecurity will be another critical area of focus, as older adults are often targeted by fraudsters. Firms must implement robust security measures while also educating their older customers on how to protect themselves online. Furthermore, financial literacy programs tailored to older adults can empower this demographic to make informed financial decisions, enhancing their financial security and confidence.

Ultimately, the goal is to create a financial ecosystem where older adults feel valued, supported, and secure, ensuring that they are not left behind in the digital transformation of financial services. By doing so, financial firms can build lasting relationships with their aging customers, driving loyalty and trust across generations.

Use Cases:

- User-Friendly Retirement Planning Tools: Developing digital platforms that help older adults plan and manage retirement savings and income in a straightforward manner.

- Hybrid Customer Service Models: Offering a combination of digital and traditional customer service options, such as in-person consultations or phone support, tailored to the preferences of older clients.

- Long-Term Care Insurance Products: Creating flexible insurance products that cover various aspects of long-term care, including in-home care and assisted living.

- Estate Planning Services: Providing comprehensive estate management tools that simplify the process of setting up wills, trusts, and inheritance plans.

- Cybersecurity Education Programs: Offering resources and workshops that educate older adults on how to protect themselves from online fraud and scams.

- Accessible Digital Interfaces: Designing financial apps and websites with larger fonts, simplified navigation, and voice command options to enhance accessibility.

- Personalized Financial Advice: Implementing AI-driven tools that provide tailored financial advice based on the unique needs and goals of older customers.

- Community Engagement Initiatives: Hosting events and workshops focused on financial literacy and retirement planning for aging populations in local communities.

- Regulatory Compliance Tools: Developing solutions that help firms comply with regulations related to elder financial protection and fiduciary duties.

- Trust-Building Campaigns: Launching marketing and education campaigns aimed at building trust in digital financial services among older adults.

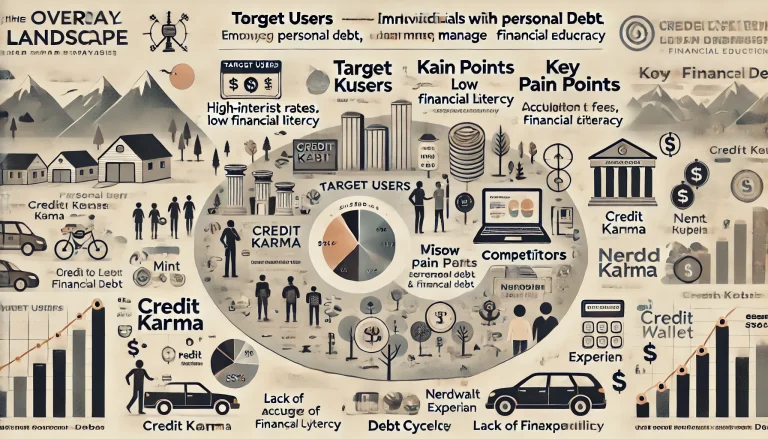

Target Users and Stakeholders:

- Target Users:

- Older Adults (Ages 55+): Both genders, seeking retirement planning, estate management, and secure financial services.

- Caregivers and Family Members: Age 35-65, both genders, looking for financial products and services to support aging relatives.

- Financial Advisors: Age 30-60, both genders, providing tailored financial advice to older clients.

- Stakeholders:

- Financial Institutions: Focused on retaining and growing their customer base by catering to the needs of older adults.

- Regulators: Ensuring that financial products and services for older adults are safe, accessible, and compliant with relevant laws.

- Technology Providers: Offering platforms and tools that enhance the accessibility and security of financial services for older adults.

- Healthcare Providers: Interested in partnerships to provide integrated long-term care solutions.

- Older Customers: Seeking user-friendly, reliable, and secure financial products that address their specific needs.

Key Competition:

- Vanguard: Offers retirement planning services and tools specifically designed for older adults.

- Fidelity Investments: Provides a wide range of retirement accounts, estate planning services, and long-term care insurance options.

- Charles Schwab: Known for its customer-centric approach, offering tailored advice and support for older clients.

- TIAA: Specializes in retirement products and services, particularly for those in the education and non-profit sectors.

- AARP Financial: Offers financial products, including retirement planning and insurance, tailored specifically for older adults.

Products/Services:

- Vanguard Retirement Planning Tools: Digital platforms that help older adults plan their retirement savings and investments with user-friendly interfaces.

- Fidelity Long-Term Care Insurance: Flexible insurance products designed to cover the costs of long-term care, including in-home care and assisted living.

- Charles Schwab Estate Planning Services: Comprehensive estate management solutions that include wills, trusts, and inheritance planning.

- TIAA Annuities: Retirement income products with various payout options tailored to the needs of older clients.

- AARP Digital Banking: User-friendly online banking services designed to meet the needs of older adults, including fraud protection and simplified navigation.

Active Startups:

- SilverBills: Provides bill management services tailored to older adults, ensuring timely payments and reducing financial stress.

- Carefull: Focuses on financial safety for older adults, offering tools to monitor accounts and prevent fraud.

- True Link Financial: Offers financial services designed for older adults, including investment management and fraud prevention tools.

- Golden: Provides retirement planning and estate management tools specifically for the aging population.

- Elderlife Financial: Specializes in financial products that help older adults manage the costs of senior living and long-term care.

Ongoing Work in Related Areas:

- AI-Driven Financial Advice: Developing AI tools that provide personalized financial advice based on the unique needs of older adults.

- Accessibility in Digital Banking: Enhancing the accessibility of digital banking platforms for older users, including voice command options and simplified interfaces.

- Cybersecurity for Seniors: Improving cybersecurity measures to protect older adults from fraud and online scams.

- Financial Literacy for Aging Populations: Creating educational programs that help older adults understand and manage their finances effectively.

- Partnerships with Healthcare Providers: Collaborating with healthcare providers to offer integrated financial and long-term care solutions.

- Regulatory Compliance Innovations: Developing tools that help financial firms comply with regulations related to elder financial protection.

- Community-Based Financial Education: Initiatives that bring financial literacy and retirement planning workshops to local communities.

- Enhanced Customer Support Models: Implementing hybrid customer service models that combine digital and traditional support options.

- Sustainable Retirement Products: Exploring sustainable investment options that cater to the ethical concerns of older adults.

- Trust-Building in Digital Finance: Campaigns aimed at building trust in digital financial services among older populations

Recent Investment:

- Carefull: Raised $3.2 million in seed funding in March 2021, led by NextView Ventures, to expand its financial safety platform for older adults.

- True Link Financial: Secured $35 million in Series B funding in January 2020, led by Khosla Ventures, to enhance its financial services for seniors.

- SilverBills: Received an undisclosed amount in Series A funding in July 2020, aimed at expanding its bill management services for the elderly.

- Golden: Raised $5 million in seed funding in October 2021, led by Index Ventures, to develop its retirement planning tools.

- Elderlife Financial: Funded by private equity in 2020 to expand its financial products focused on senior living and long-term care.

Market Maturity:

The market for financial services tailored to aging populations is becoming increasingly mature as firms recognize the growing demand for products that address the specific needs of older adults. While traditional financial services have historically focused on younger, more tech-savvy customers, there is now a clear shift towards inclusivity, with more resources being allocated to developing accessible, secure, and user-friendly financial solutions for older adults. The rise of fintech startups targeting this demographic, coupled with significant investments from established firms, indicates a market poised for growth. As the global population continues to age, the financial industry will need to innovate continuously to meet the evolving needs of older customers, making this a critical area of focus for the future.

Summary :

The aging population presents both challenges and opportunities for financial firms, requiring a delicate balance between innovation and inclusivity. Older adults have unique financial needs, including retirement planning, long-term care, and estate management, which necessitate specialized products and services. However, the digitalization of financial services poses a significant challenge, as many older customers may struggle with or feel uncomfortable using digital platforms. To address these challenges, financial firms must design user-friendly interfaces, offer personalized customer support, and develop products tailored to the financial goals of older adults.

Moreover, cybersecurity is a critical concern, as older adults are often more vulnerable to fraud. Financial institutions must implement robust security measures while also educating their older customers on how to protect themselves online. By creating a financial ecosystem that is accessible, secure, and tailored to the needs of aging populations, financial firms can ensure that no customer is left behind in the digital transformation of financial services. The market is ripe for innovation, with significant investments flowing into startups and established firms that are developing solutions for this growing demographic. As the global population continues to age, the ability to serve older customers effectively will become a key differentiator in the financial industry.